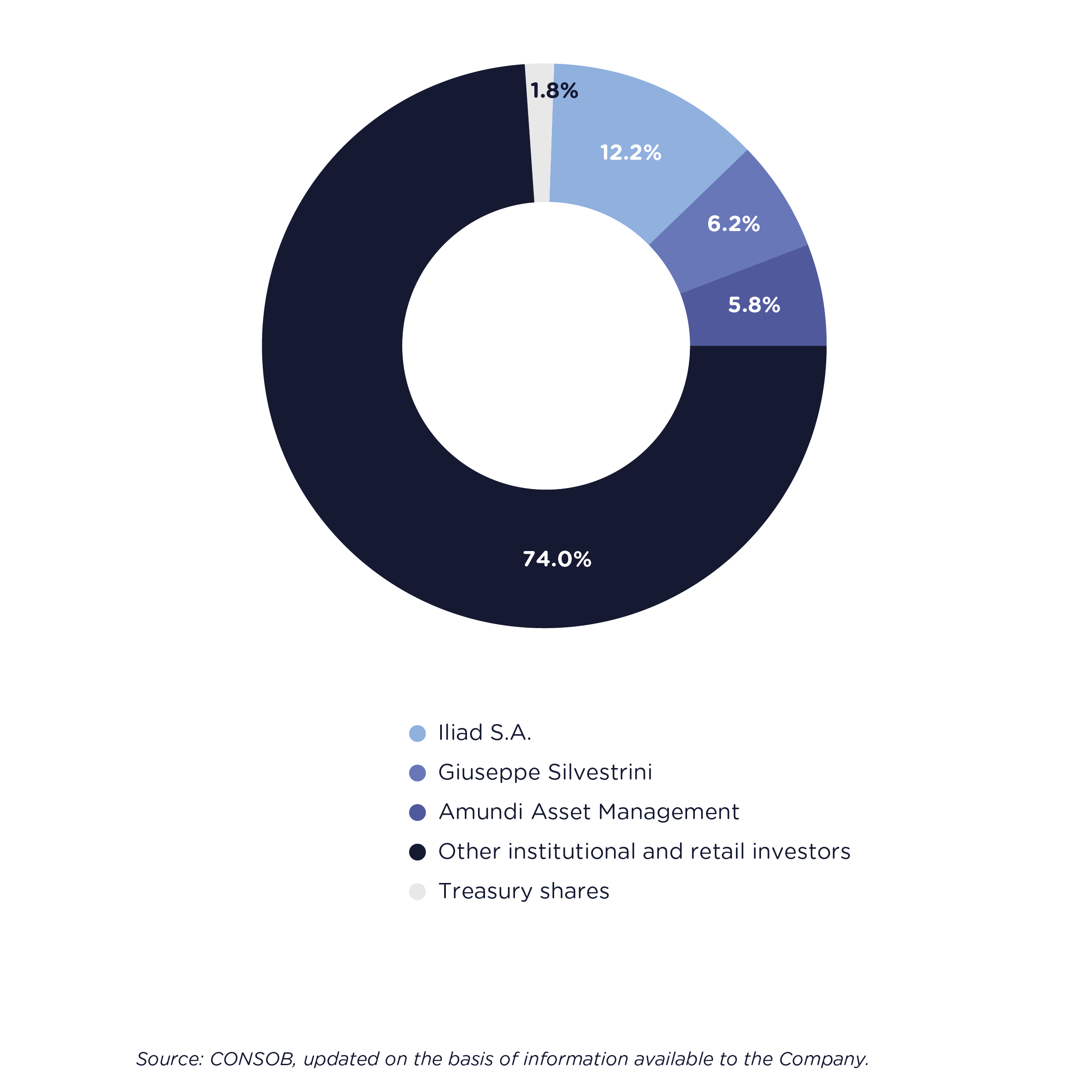

Unieuro features an extensive and fragmented shareholder base, and thus is structured like a public company. The chart below displays shareholders who have declared that they exceed the relevant shareholding threshold per Article 120 of the Consolidated Finance Act.

View and download the reference documents for the Shareholders' Agreements of Unieuro S.p.A.

12.01.2019

Excerpt from the Shareholders’ Agreements of Unieuro S.p.A. (available in Italian only)

Read07.10.2017

Excerpt from the Shareholders’ Agreements of Unieuro S.p.A. (available in Italian only)

Read15.04.2017

Excerpt from the Shareholders’ Agreements of Unieuro S.p.A. (available in Italian only)

Read